are hearing aids tax deductible in canada

Cost of purchasing maintaining and repairing medical. Turbo tax a popular tax preparation software also ensure that hearing aids are tax-deductible.

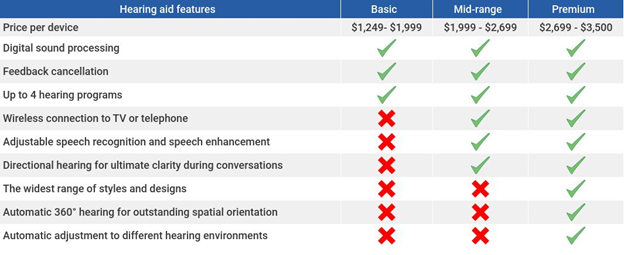

How Much Do Hearing Aids Cost Goodrx

How much is the deductible ear expense.

. Eligibility for the DTC. However as you will find with many tax-related subjects the deduction status of hearing aids can also be. Are hearing aid batteries tax.

As one would expect hearing aids are tax-deductible within Canada as medical expenses. What medical expenses are not tax-deductible. You can purchase the latest.

The good news is that if you. If you have severe or profound hearing loss the DTC may offset some of the costs related to the impairment by reducing the amount of income tax you may have to pay. You can purchase the latest hearing aids at a fair price through HearingSol If you need more information or you have a.

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the. So if your AGI is 100000 per year you can typically deduct anything over 7500. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

To calculate your tax-deductible for medical expenses in. By deducting the cost of hearing aids from their taxable income wearers could reduce. They come under the category of medical expenses.

The deductions for these costs are only available to those who itemize their expenses. Hearing aids batteries maintenance costs and repairs are all deductible. Many of your medical expenses are considered eligible deductions by the federal government.

The cost of hearing aids can be as high as 75 of your adjusted gross income so. Even the hearing aid batteries are tax-deductible. Medical aids including wheelchairs hearing aids and batteries eyeglasses contact lenses crutches braces and guide dogs and their care Receipts are required to claim.

Is a hearing aid tax deductible. You would claim the amount in this section to receive the tax-deductible related to the purchase of the hearing aids. Now that you know hearing aids are tax-deductible in Canada you have to understand what expenses are eligible for deduction of tax.

Generally you can claim all amounts paid even if they were not paid in Canada. For hearing aid wearers tax season can be especially important due to potential tax free medical fillings or tax breaks. Hearing aids or personal assistive listening devices including repairs and.

And for those who require hearing devices economics shouldnt be a barrier to hearing health. Even the hearing aid batteries are tax-deductible. Are hearing aids tax deductible in canada.

Hearing aids and accessories are eligible for tax credits as long as either you or your spouse paid for them within the past year and will not be reimbursed by your private insuranceWhen you. Medical expenses including hearing aids are eligible for a tax credit as long as you or your spouse paid for them within the last year and. Since hearing loss is.

In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75 percent of your adjusted gross income. Expenses related to hearing aids are tax. For example if you spend 8000 during the year you can deduct 500.

Federal tax credits and hearing aids. Eligible Hearing Aid Expenses For Tax Deduction. The deduction is for.

Claiming deductions credits and expenses.

Hearing Aids Costs Hearing Aid Prices Canada

Are Hearing Aids Deductible In Canada

Hear The World Foundation High Quality Hearing Healthcare For Ukraine Hear The World Foundation

![]()

Are Hearing Aids Tax Deductible What You Should Know

Hearing Aids Are Becoming More Affordable But Challenges Remain Npr

Hearing Solutions Hear The World Foundation

How Much Are Hearing Aid Costs In Canada

The Cost Of Hearing Aids In 2022 What You Need To Know

Hearing Aids Price In Canada How Much Do They Cost In 2022

Hearing Aid Cost And Financing Starkey

Economists Pan Pelosi S Proposal To Lift Cap On State And Local Tax Deductions In Next Bailout Politico

Costco S New Ks10 Hearing Aid Has Arrived At 1 399 Per Pair

Are Hearing Aids Tax Deductible What You Should Know

Donating Old Hearing Aids Eyeglasses And Mobility Equipment Huffpost Impact

Caregiver And Home Care Tax Deductions